CPAs to Clients: The IRS is Coming for Cryptocurrency

CPA Practice

AUGUST 16, 2023

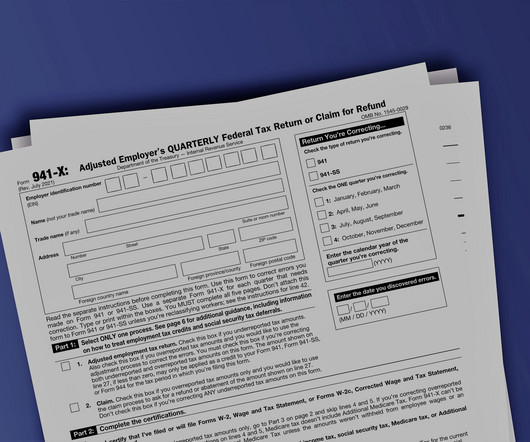

The federal agency launched Operation Hidden Treasure in 2021, for example, to root out taxpayers who fail to report income from cryptocurrency transactions on their federal tax returns. The IRS is looking for unreported assets,” said Lucas Rihely, a tax partner at H2R CPA. And that’s just the beginning.

Let's personalize your content